Arthur Lynch | Sun Aug 10 2025

What Is 925 Silver Worth? A Practical Guide to Value

So, what's a piece of 925 silver really worth? There's no single, simple answer. Its value is a fascinating mix of its raw metal content, the artistry involved in its creation, and the whims of market demand. That "925" stamp is your starting point—it guarantees the item is 92.5% pure silver, giving it a foundational value tied directly to the global metals market.

What Determines The True Worth of 925 Silver?

Think of a sterling silver item's value like a vintage guitar. Sure, it has a base value for its wood and hardware. But its final price truly depends on who made it, its condition, its history, and how many people want that specific model. In the same way, the 925 silver worth begins with its metal content but certainly doesn't end there.

This guide will break down all the moving parts that contribute to a silver piece's final price tag, giving you a clear framework and actionable insights for understanding its complete value.

The Foundation: Metal Content and Spot Price

At its core, your silver's worth is anchored to the global price of the metal itself. This price, known as the "spot price," is constantly in flux, changing daily based on everything from mining output and industrial demand to investor sentiment.

The market has been particularly active recently. As of early 2025, silver is hovering around $38.34 per troy ounce. This is a significant jump, largely fueled by surging demand in high-tech sectors like solar panel manufacturing and electric vehicles. Because of this dynamic market, the inherent value of your 925 silver is directly connected to these sweeping economic trends. You can explore more about these market dynamics to get a better handle on silver's investment outlook.

Beyond the Melt Value: Artistry, Brand, and Condition

While the spot price gives you a baseline, just melting a piece down often misses the bigger picture—and a lot of potential value. Several other factors come into play, each capable of pushing an item's worth far beyond its raw material cost.

This table breaks down the key components that build upon the foundational metal value.

Components of 925 Silver's Value

| Value Component | Description | Example Impact |

|---|---|---|

| Craftsmanship | The skill, detail, and artistry invested in creating the piece. Was it handmade by a master silversmith or mass-produced? | A unique, hand-engraved cuff bracelet from a known artist will be worth significantly more than a simple, machine-made chain of the same weight. |

| Designer or Brand | The reputation and prestige associated with the maker. Well-known brands often command a premium. | A vintage ring from a famous design house like Tiffany & Co. has a built-in value from its name alone, far exceeding its silver content. |

| Age and Rarity (Provenance) | The item's history, origin, and how many of its kind exist. Antique or vintage pieces from a notable era are highly collectible. | An Art Deco-era necklace is more than just silver; it's a piece of history. Its rarity and historical significance add immense value. |

| Condition | The physical state of the item. Scratches, dents, and broken parts can reduce its value, while pristine condition enhances it. | A well-preserved antique silver locket will fetch a much higher price than an identical one that is heavily tarnished, dented, or missing parts. |

| Market Desirability | Current fashion trends and collector demand. What's popular right now can dramatically influence an item's price. | Bold, chunky Southwestern turquoise jewelry might be in high demand one year, making those pieces temporarily more valuable than more classic styles. |

As you can see, the story behind the silver is often just as important as the silver itself.

A handcrafted piece from a respected artisan or a vintage item from an iconic brand carries a story and a level of craftsmanship that mass-produced items lack. This uniqueness is a powerful value multiplier.

To put it simply, understanding the 925 silver worth means looking at both the metal and the magic—the raw material and the human touch that transformed it into something more.

How Purity and Hallmarks Define a Silver Item's Base Value

Before you can figure out what your silver is worth, you have to understand what "925" actually means. Think of it like a trusted recipe. On its own, pure silver is just too soft and delicate for most jewelry—it would bend and scratch far too easily. To make it both beautiful and tough enough for daily life, silversmiths mix it with other metals.

That's where the 925 standard comes in. It's a precise, internationally recognized formula: 92.5% pure silver mixed with 7.5% of another metal, usually copper. This alloy gives the silver the strength it needs to become a durable ring or a sturdy chain. This specific blend is the very foundation of sterling silver's identity and its baseline value.

Reading the Story Stamped in Silver

So, how do you know you're getting the real deal? You look for the hallmark. This tiny stamp is more than just a mark; it’s a promise. It’s the universal language of silver, guaranteeing the purity of the metal and sometimes even telling you a bit about its history. Learning to spot and understand these marks is your first step in confidently assessing any silver item's worth.

While the "925" stamp is the most common, different countries and eras have used various marks to say the same thing. Keep an eye out for these:

- "925": The clearest and most widely recognized mark for sterling silver.

- "STERLING" or "STER": A classic stamp, you'll see this often on pieces from the US and the UK.

- Lion Passant: This walking lion is an iconic historical symbol from British assay offices, a surefire sign of sterling quality.

- Maker's Marks: These initials or symbols identify the craftsman or company behind the piece. A respected maker's mark can add a whole other layer of value beyond the silver content itself.

These hallmarks essentially act as a quality control system for the entire industry. They provide assurance that what you're buying is exactly what it claims to be. You'll see these marks on all authentic pieces, like this collection of 925 sterling silver rings, where each one carries a stamp confirming its composition.

Comparing Silver Purity Standards

Of course, "925" isn't the only type of silver out there. Seeing how it stacks up against other purities really shows why it has become the gold standard—or, well, the silver standard—for high-quality jewelry. Each type has a unique purity that affects its look, feel, and ultimately, its value.

A hallmark is a promise of quality etched in metal. It provides a transparent, verifiable measure of purity that serves as the starting point for all value calculations.

Let's break down the common types of silver you might run into:

| Silver Type | Purity Level | Common Use & Characteristics |

|---|---|---|

| Fine Silver | 99.9% (marked "999") | Incredibly soft with a brilliant luster. It's mainly for investment bullion or very delicate artistic pieces not meant for wear and tear. |

| Sterling Silver | 92.5% (marked "925") | The global standard for jewelry. It hits the sweet spot between brightness, strength, and workability, making it perfect for everyday pieces. |

| Coin Silver | ~90% (often unmarked) | Just like the name says, this was historically used to make coins. It’s less pure and you won't find it in modern high-quality jewelry. |

This quick comparison makes it obvious why 925 sterling silver is king in the jewelry world. Its composition offers the ideal marriage of precious metal value and real-world durability, which firmly establishes its worth before you even start to consider factors like craftsmanship or brand name.

A Step-by-Step Guide to Calculating Silver Melt Value

Figuring out the baseline 925 silver worth is much easier than most people think. It all starts with the "melt value"—a calculation that strips away everything but the pure, raw silver content in your item. Think of it as ignoring the brand, the design, and the sentimental history to get straight to the metal's intrinsic value.

This process comes down to a simple, three-step formula that you can do right at home with a decent scale, a quick Google search, and a calculator. It’s like finding out the cost of the ingredients before a chef works their magic.

The Three-Step Melt Value Formula

To get a number you can trust, just follow these steps. Be precise, especially with the weight—a small error here can throw off the whole calculation. A common mistake I see is people using their kitchen food scale, which just isn't sensitive enough. You'll want to use a digital jeweler's scale or a gram scale for the best results.

- Weigh Your Item in Grams: Get the total weight of your 925 silver piece on an accurate digital scale. Jot that number down.

- Find the Silver Spot Price: Hop online and search for the current "silver spot price per gram." This price changes constantly, so make sure you're using today's number.

-

Calculate the Value: Now, plug your numbers into this simple formula:

(Total Weight in Grams) x (Current Spot Price per Gram) x (0.925) = Melt Value

That final step—multiplying by 0.925—is the most important part. It adjusts the math for the fact that sterling silver is 92.5% pure silver, so you're only paying for the good stuff.

A Practical Example

Let's walk through a real-world scenario. Say you have a sterling silver bracelet and your scale reads 20 grams. A quick search shows you the silver spot price is $1.23 per gram today.

Here’s how the math breaks down:

20 grams (Weight) x $1.23 (Spot Price) x 0.925 (Purity) = $22.75

Just like that, you know the melt value of your bracelet is roughly $22.75. This is your foundational value, the absolute minimum it’s worth. Keep in mind, though, that this number doesn't include any other factors that could push its price higher.

Of course, the story doesn't end with melt value. Sterling silver has a life of its own in the collectibles and artisan markets, which adds a whole other layer of value. While the raw metal value tracks silver's spot price (around $38 per ounce in 2025), things like antique flatware, unique jewelry, and vintage tea sets can sell for way more than their weight in silver. This is especially true now, with a growing trend of repurposing old silverware into beautiful artisan jewelry or home decor. To dig deeper into this, you can learn about 2025 sterling silver values on SebastianCharles.com.

It’s Often Worth More Than Just the Metal

The melt value gives you a solid, reliable floor for your item's worth, but honestly, that’s often just the starting point. The true value of a piece of 925 sterling silver is frequently found in factors that have nothing to do with a scale or a market report. These are the elements that can transform a simple silver object into a prized collectible or a must-have fashion statement.

Think of it like this: the silver content is the canvas, but the artistry, history, and brand are the painting itself. A blank canvas has a set cost, but the artwork on it can be priceless. In the same way, a generic silver chain has a predictable value based on its weight, while a designer piece with the exact same silver content can be worth exponentially more.

Let's dig into the key multipliers that savvy collectors and informed buyers always look for.

Artisan Craftsmanship and Designer Brands

The hands that shaped the silver and the name behind the design are often the biggest value boosters. A piece stamped with a famous brand like Tiffany & Co., Georg Jensen, or Cartier carries an immediate premium. Why? Because those names represent a legacy of quality, iconic design, and prestige that elevates the item far beyond its raw materials.

The difference between a mass-produced silver ring and a handmade one from a known artisan is like the difference between a poster and an original painting. Both use similar materials, but one has a unique story, skill, and soul embedded right into it.

It’s not just about the big luxury houses, either. The skill of an individual artisan can create tremendous value.

- Actionable Insight: Check for handiwork. Look for signs of intricate, manual work a machine can't replicate, like delicate hand-engraving, complex filigree, or perfectly executed soldering. This is where hidden value often lies.

- Unique Design: A one-of-a-kind piece from an independent silversmith is inherently rare, making it far more valuable to collectors hunting for something truly original.

- Artistic Merit: Does the piece simply look good? This is subjective, but a high level of artistic vision and execution is a major price driver.

Historical Significance and Rarity

Age by itself doesn't automatically mean value, but age combined with historical context and rarity? That’s a powerful combination. An item’s provenance—its documented history of ownership—can significantly boost its worth. A silver locket is just a locket, but one proven to have belonged to a notable historical figure suddenly becomes a valuable artifact.

Likewise, pieces from specific design eras are highly collectible. An Art Deco brooch or a Victorian mourning ring isn’t just jewelry; it’s a tangible piece of history that tells a story about the time it came from. The fewer of these items that have survived in good condition, the more valuable they become.

Global and Regional Jewelry Fashion Trends

Value is also swayed heavily by what’s in style right now. Fashion is cyclical, and a design that was overlooked a decade ago might be today’s hottest trend. This is where keeping an eye on global and regional styles gives you a huge advantage.

Currently, several key trends are boosting the value of specific types of 925 silver:

- Scandinavian Modernism: The clean lines and minimalist cool of vintage designers from Denmark, Sweden, and Finland are in high demand globally, fitting perfectly with modern tastes.

- Bohemian and Southwestern Styles: In regions like the American Southwest and Australia, bold turquoise and silver pieces are timeless fashion staples that hold their value incredibly well.

- The "Neck Mess" Layering Trend: This global trend, popularized on social media, has driven up the demand and worth of both vintage and new sterling silver necklaces as consumers seek multiple delicate chains and pendants to layer.

- Actionable Insight: Check social media. Search hashtags like #sterlingsilverjewelry, #vintagesilver, or #neckmess on Instagram and TikTok to see what styles are currently trending with influencers and consumers.

By understanding these multipliers—craftsmanship, brand, history, rarity, and trends—you can start to see beyond the metal itself. This is how you spot the hidden potential that determines the true 925 silver worth.

How Global Market Trends Influence Your Silver's Price

The value of your 925 silver isn't a fixed number you can look up in a book. It’s alive, constantly shifting with the currents of the global economy. Think of it like a weather forecast for the silver market; understanding these forces gives you the insight to know when it’s the right time to buy, sell, or simply hold onto your pieces.

Silver has a fascinating dual identity in the world economy. It's both a safe-haven asset people turn to in uncertain times, much like gold, and a critical industrial commodity. This unique position means its price gets pulled in different directions by very different economic forces, which creates both volatility and opportunity.

Industrial Demand and Tech Innovation

A huge part of what drives the 925 silver worth today is its indispensable role in modern technology. As one of the most conductive metals on the planet, silver is a key ingredient in everything from the smartphone in your pocket to sophisticated medical devices.

Right now, the biggest push is coming from the green technology boom. Silver is absolutely essential for manufacturing:

- Solar Panels (Photovoltaics): A special silver paste is used to conduct electricity out of solar cells. As the global push for renewable energy intensifies, the demand for solar panels—and the silver inside them—is skyrocketing.

- Electric Vehicles (EVs): EVs use far more silver than gas-powered cars. It’s found in countless electronic components, from battery connections to circuit boards and infotainment systems.

This growing industrial appetite creates a strong, consistent demand for silver, which directly props up its price. When tech manufacturing is booming, the value of your silver often climbs right along with it.

Silver's value is uniquely tied to progress. As technology advances and the world shifts towards greener energy, the demand for this essential metal is projected to grow, creating a solid foundation for its long-term worth.

Investor Behavior and Economic Stability

Beyond its life in factories, silver is a classic precious metal. When the economy feels shaky—think inflation, geopolitical tension, or a wobbly stock market—investors often run to tangible assets like silver and gold. They see it as a reliable store of value when currencies and stocks feel risky. This "flight to safety" can trigger sharp, rapid price spikes.

Historically, the price of silver has been volatile, but it has shown a clear upward trend tied to these economic and industrial pressures. For instance, between 2018 and 2025, the price per kilogram of silver shot up from around $596 to nearly $1,268—a jump of over 112%. This impressive growth shows how supply issues and soaring demand from sectors like green tech directly boost its value.

Jewelry Fashion and What's in Style

Finally, you can't ignore fashion. Global and regional trends add another fascinating layer to the story. As styles change, so does the demand for specific types of jewelry, which can affect the 925 silver worth for certain items.

For example, the worldwide trend of layering delicate necklaces has fueled demand for fine sterling silver chains. You can get a feel for what’s popular right now by browsing a wide range of 925 sterling silver jewelry. These fashion currents can create windows of opportunity, allowing you to sell particular pieces for a premium when they're in high demand.

Getting the Best Price When You Sell Your Silver

When it's time to sell your sterling silver, a little bit of homework can make a huge difference in how much cash you walk away with. The secret isn't complicated: it's all about knowing your options and having a smart game plan. If you navigate the process correctly, the 925 silver worth you get will be a fair reflection of its value, not just a lowball melt price.

You've got a few main places to sell: local jewelry shops, dedicated online precious metal buyers, and big marketplaces like eBay. Each route has its own set of trade-offs. A local jeweler can give you cash on the spot, but their offer might be lower to cover their own overhead. Online buyers can be very competitive, but you'll have to ship your silver. Platforms like eBay open your items up to a huge audience, but you'll have to deal with fees and the hassle of shipping yourself.

How to Prepare for a Great Sale

Before you even think about accepting an offer, you need to get several of them. This is the single best thing you can do to get a feel for the market and spot a bad deal. An offer that feels a little low might actually be the going rate, but you’ll never know for sure without a few other quotes to compare it to.

Here’s a crucial tip, especially for older or antique pieces: don't clean them! That layer of tarnish, which experts call patina, is often a sign of age and history that serious collectors actively look for. Polishing it can literally scrub away its value.

Never, ever take the first offer you get. Make it a rule to get at least three different quotes. This simple step puts you in a position of power and helps you understand what a truly fair market price looks like.

Making Sense of the Buyer's Offer

When you get a quote, expect it to be lower than the spot price you might have calculated. This is completely normal. Remember, the buyer is running a business. They have costs to cover—like testing, refining, and, of course, their own profit margin. A trustworthy buyer will generally offer somewhere in the range of 70% to 90% of the silver's actual melt value.

Don't forget that style and trends matter, too. For example, delicate, layered chains are hugely popular right now, which means certain sterling silver necklaces can command a better price. Retailers who need to stock up on in-demand styles, like those looking for trendy 925 sterling silver necklaces, are often willing to pay a premium. Knowing what's hot gives you a real edge at the negotiating table.

Common Questions About 925 Silver Value

After digging into all the details, you might still have a few questions rattling around. That's perfectly normal. Let's tackle some of the most common ones head-on, giving you the last few pieces of the puzzle to understand what your silver is really worth.

Is Tarnished Silver Worth Less Money?

When it comes to melt value, tarnish means absolutely nothing. Think of it as a bit of dust on the surface—it’s just a thin chemical layer that vanishes the moment the silver hits the melting pot.

But, if you're dealing with an antique or a collectible piece, that tarnish tells a story. It's often called patina, and to a collector, it’s a beautiful sign of age and authenticity. In these cases, reaching for the polish can be a costly mistake. Cleaning off a century of history can actually tank its value, so it's often best to leave it untouched.

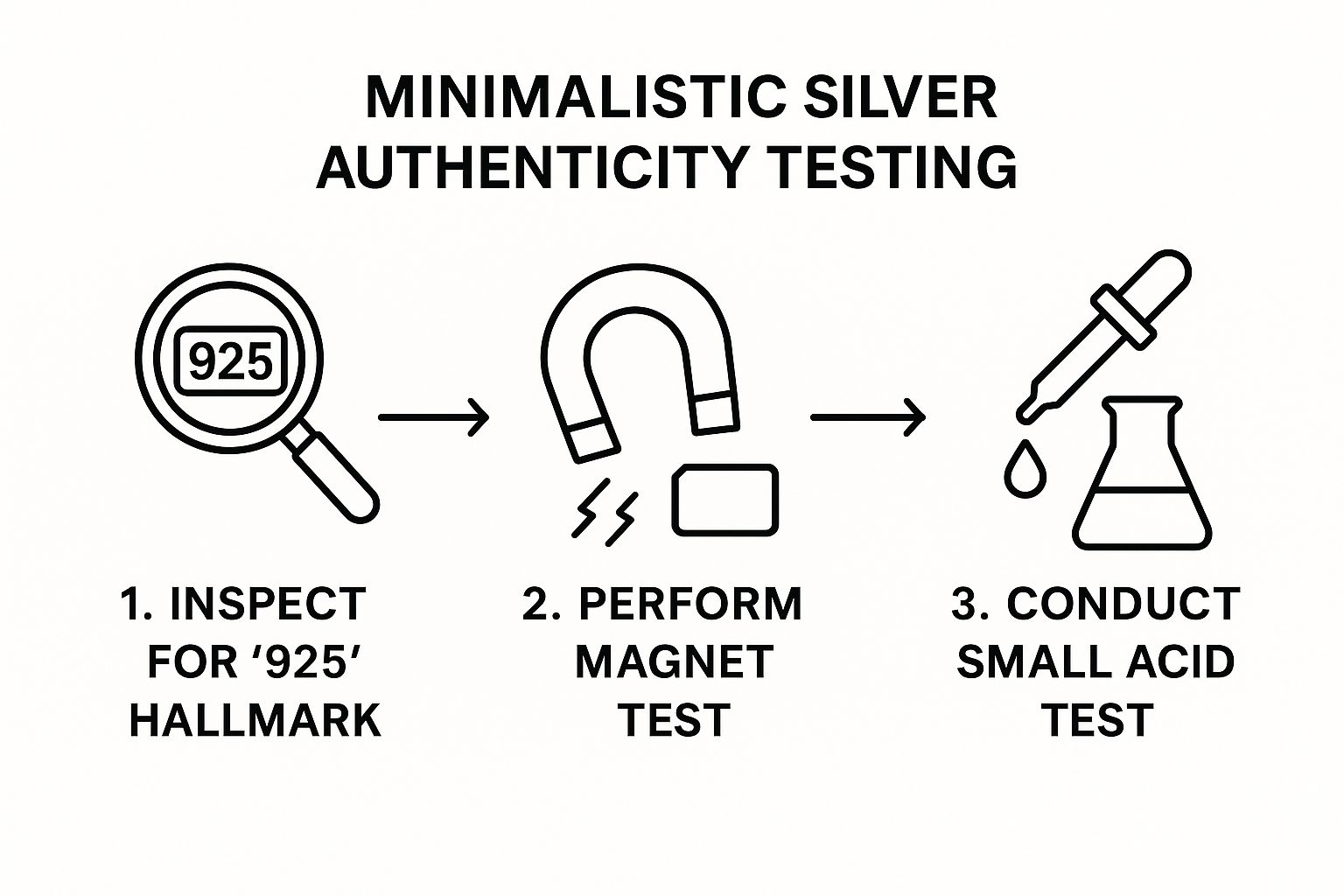

How Can I Tell If My Item Is Real Sterling Silver?

Your first step is to play detective. Look closely for tiny stamps or hallmarks. Markings like "925," "STERLING," or "STER" are the gold standard indicators that you're holding the real deal.

Next, try a simple magnet test. Real silver isn't magnetic, so if a magnet snaps right onto your item, you're likely looking at silver-plated steel or another base metal. If the piece feels particularly valuable or you're just not sure, getting a professional appraisal is always the safest bet for confirming its authenticity.

Remember, a buyer's offer will always be below the spot price. Reputable dealers typically offer between 70-90% of the melt value. This isn't a scam; it's how they cover their business costs, refining fees, and make a small profit.

Why Was I Offered Less Than the Melt Value?

It can be a little jarring to calculate your silver's melt value, only to be offered less. But there's a simple business reason for it.

Pawnshops, jewelers, and online refiners all have overhead—rent, employee salaries, and the cost of the refining process itself. Their offer has to account for these expenses while leaving room for a profit margin. It's just standard practice in the industry. The best way to make sure you’re getting a fair shake is to shop your silver around and get quotes from a few different buyers before you sell.

At JewelryBuyDirect, we give jewelry professionals an edge with direct-from-factory pricing and the inside track on today's hottest trends. We're here to help you maximize your value and style. To see what we mean, explore our huge collection of high-quality sterling silver and elevate your inventory by visiting JewelryBuyDirect.com.

to show code

to show code