Arthur Lynch | Sat Oct 04 2025

What Is the Value of 925 Silver Today

So, what’s your 925 silver really worth? The answer isn't as simple as checking the daily stock market report for silver prices. While that's part of the story, it's just the first chapter.

The value of any sterling silver piece is a fascinating blend of its raw material worth and its artistic soul—the craftsmanship, the designer behind it, and even its history. Think of it like a classic car; you wouldn't value a vintage Ferrari just for its scrap metal, would you? The same principle applies here.

Understanding the Real Worth of 925 Silver

At its core, 925 sterling silver is 92.5% pure silver mixed with 7.5% other metals for durability. That 92.5% gives us a baseline—the "melt value"—which is directly tied to the daily spot price of silver. But that's just the starting point, and frankly, it's the least interesting part of the equation.

The real value emerges when you look beyond the weight. Imagine two silver rings that weigh exactly the same. One is a simple, mass-produced band you can find anywhere. The other is a handcrafted piece from a renowned artisan like Tiffany & Co.. The designer piece will always be worth significantly more, not because of the silver content, but because of the name, the artistry, and the quality woven into its creation.

Let's break down the key factors that build the total value of a 925 silver item.

| Component | Description | Impact on Value |

|---|---|---|

| Intrinsic Metal Value | The base worth of the 92.5% pure silver in the item, based on the current market spot price. | Low to Moderate. This is the floor value; it can't be worth less than its melt-down price. |

| Craftsmanship & Artistry | The skill, detail, and complexity of the design. Was it handmade or mass-produced? | Moderate to High. Exceptional craftsmanship from a skilled artisan adds significant value. |

| Brand & Designer | The reputation of the brand or designer. A piece from a famous house carries a premium. | High. A well-known name can multiply the item's value far beyond its material worth. |

| Age & Rarity | Is it a vintage or antique piece? Is it a limited edition or a one-of-a-kind item? | Moderate to High. Rarity and historical significance can make a piece highly collectible. |

| Condition | The physical state of the item. Scratches, tarnish, or damage can reduce its worth. | Moderate. Excellent, like-new condition preserves the value, while damage detracts from it. |

Ultimately, these components work together. A rare, antique piece from a famous designer in perfect condition represents the peak of value, while a simple, modern, mass-produced item will be valued much closer to its base metal price.

Fashion And Global Trends: Tapping into Market Demand

Don't underestimate the power of trends. What's hot right now in the fashion world directly influences the desirability—and therefore the market price—of certain styles. Understanding these trends is an actionable strategy for maximizing value.

For example, the global trend towards "quiet luxury" has amplified demand for sleek, understated 925 silver jewelry. In North America and Europe, minimalist Scandinavian designs, delicate chains, and simple geometric shapes are highly sought after. A piece that aligns with this aesthetic will sell faster and for a premium.

Conversely, in many parts of Asia and the Middle East, the trend leans towards maximalism and tradition. Ornate, intricate patterns that reflect cultural heritage are prized. In India, for instance, oxidized silver Jhumka earrings or heavy Payal anklets are consistently in demand. A piece that might seem "busy" to a Western buyer could be a bestseller in these markets.

Actionable Insight: Assess your silver jewelry's style. Is it minimalist or ornate? Modern or traditional? Use this to identify its most profitable market. A sleek, modern piece might perform best on a platform targeting European buyers, while an intricate, traditional item could fetch a higher price in a market that values detailed craftsmanship.

To determine the true value of 925 silver, you must analyze the whole picture:

- Intrinsic Metal Value: Calculate the base price using the daily silver spot price.

- Artistic and Brand Value: Research any maker's marks to see if a premium for a designer or brand applies.

- Market Desirability: Identify the style and align it with current global and regional fashion trends to find the right buyer.

The Silver Spot Price: The Foundation of 925 Silver's Value

So, what really determines how much your 925 silver is worth? It all starts with the global spot price of pure silver. Think of this as the live, up-to-the-minute price for one ounce of raw silver, and it’s always on the move, reacting to global supply and demand.

This spot price is the "raw ingredient" cost in your jewelry or silverware. Because sterling silver is an alloy made of 92.5% pure silver, its fundamental value—what we call its "melt" value—is directly tied to that number. This gives us a solid baseline for what the metal itself is worth at any given moment.

How to Calculate the Base Value

The math is actually pretty simple. You just take the current spot price of pure silver and multiply it by 0.925.

Let’s say pure silver is trading at $30 per ounce. The melt value of one ounce of your sterling silver would be $27.75 ($30 x 0.925). It's that easy. This calculation gives you the starting point before you factor in things like artistry or a famous brand name.

The value of 925 silver, also known as sterling silver, is closely tied to the spot price of pure silver (999 fine silver) but typically trades at a slight discount due to its 92.5% purity with the remainder being other metals like copper to improve durability. Because sterling silver contains 92.5% pure silver, its intrinsic metal value can be approximated by multiplying the spot silver price by 0.925. For example, whereas pure silver reached $48/ounce in October 2025, 925 silver would have an intrinsic value of roughly $44.40 per ounce. Discover more insights on technical silver price trends at VRXRF.

What Makes the Spot Price Fluctuate?

Knowing why the spot price changes is where you really start to understand the market for 925 silver. These movements aren't random; they're driven by powerful real-world forces.

Here’s a look at the big three:

- Industrial Demand: Silver is a workhorse metal. It’s absolutely essential for manufacturing things like solar panels, electric vehicle (EV) batteries, and countless electronics. This steady industrial need creates a strong floor for its price.

- Investor Sentiment: When the economy feels shaky or inflation is on the rise, people often flock to precious metals as a safe place to put their money. This "safe-haven" buying can push silver prices higher.

- Global Supply: How much silver is being pulled out of the ground matters. Mining production levels and even political instability in major silver-producing countries can squeeze the available supply, which in turn affects the price.

Keeping an eye on these factors helps you understand the story behind the price, not just the number on the screen.

Beyond Melt Value: How Craftsmanship and Brand Shape Worth

The spot price of silver is just the starting point—the foundation of a piece’s value. What truly determines its worth is the story it tells through its design, the skill of its maker, and the reputation of its brand.

Think about it: why does a simple Tiffany & Co. bracelet cost so much more than a generic one with the exact same weight in silver? The answer is in the artistry and the legacy we value. This is what turns a piece of metal into wearable art. A generic piece is a commodity; a designer piece is a collectible.

The Power of Design and Desirability

Fashion and cultural trends have a massive impact on the value of 925 silver jewelry. Understanding what’s popular in different regions is a key strategy for unlocking a piece's true market potential.

- Minimalist & Sustainable Movements: Across North America and Europe, there's a strong appetite for minimalist designs and sustainable brands. Clean lines, geometric shapes, and ethically sourced materials command a premium. This trend favors artisan-made pieces over mass-produced items.

- Traditional & Bold Statements: In many Asian markets, particularly China and India, value is often placed on intricate, traditional patterns and bold statement pieces. Designs that symbolize prosperity, heritage, or spirituality are highly prized. Latin American markets also show a preference for bold, artistic silverwork, often incorporating natural stones like turquoise.

Actionable Insight: When selling a piece, tailor your description to highlight trendy features. Use keywords like "minimalist," "Scandinavian design," or "sustainable" for Western audiences. For other markets, emphasize "handcrafted," "traditional," or "intricate detailing" to attract the right buyers.

Maker's Marks and Brand Recognition

Just like a painter signs their work, jewelers use tiny stamps called maker’s marks to identify their creations. These little imprints are your best clues to uncovering hidden value. If you spot a mark from a famous designer or see a style from a specific era, like Art Deco, you instantly know the piece is more valuable.

Sterling silver has always been a solid store of value because it's both a precious metal and something incredibly useful. This stability has made it a prized commodity worldwide, especially in cultures where jewelry plays a big role. Lately, a growing interest in sustainable, handcrafted goods has also boosted the demand for older pieces, pushing their value well beyond their simple melt price.

Recognizing these details is a crucial skill, whether you're selling a vintage find or looking to start your own jewelry line. For a deeper dive into this, check out our guide on https://www.jewelrybuydirect.com/blogs/how-to-price-handmade-jewelry.

Your Guide to Appraising and Selling 925 Silver

Knowing what 925 silver is worth in theory is great, but the real trick is figuring out how to appraise your specific items and sell them for a fair price. Let’s walk through the steps to uncover what your silver is really worth and how to get the best possible return.

It all starts with a couple of simple, hands-on checks. First, grab your piece and look closely for any tiny stamps or engravings. You're searching for hallmarks like "925," "Sterling," "STER," or "STG." These marks are the maker's guarantee of its silver content.

Next, you'll need its weight. A simple kitchen or jewelry scale will do the trick. This measurement gives you a baseline value for the metal itself, which is crucial for the next step.

Finding the Right Selling Channel

With those basic details in hand, you can start thinking about where to sell. This decision is probably the most important one you'll make, as it directly affects your final payout. Are you selling a piece for its raw metal value or for its value as a collectible?

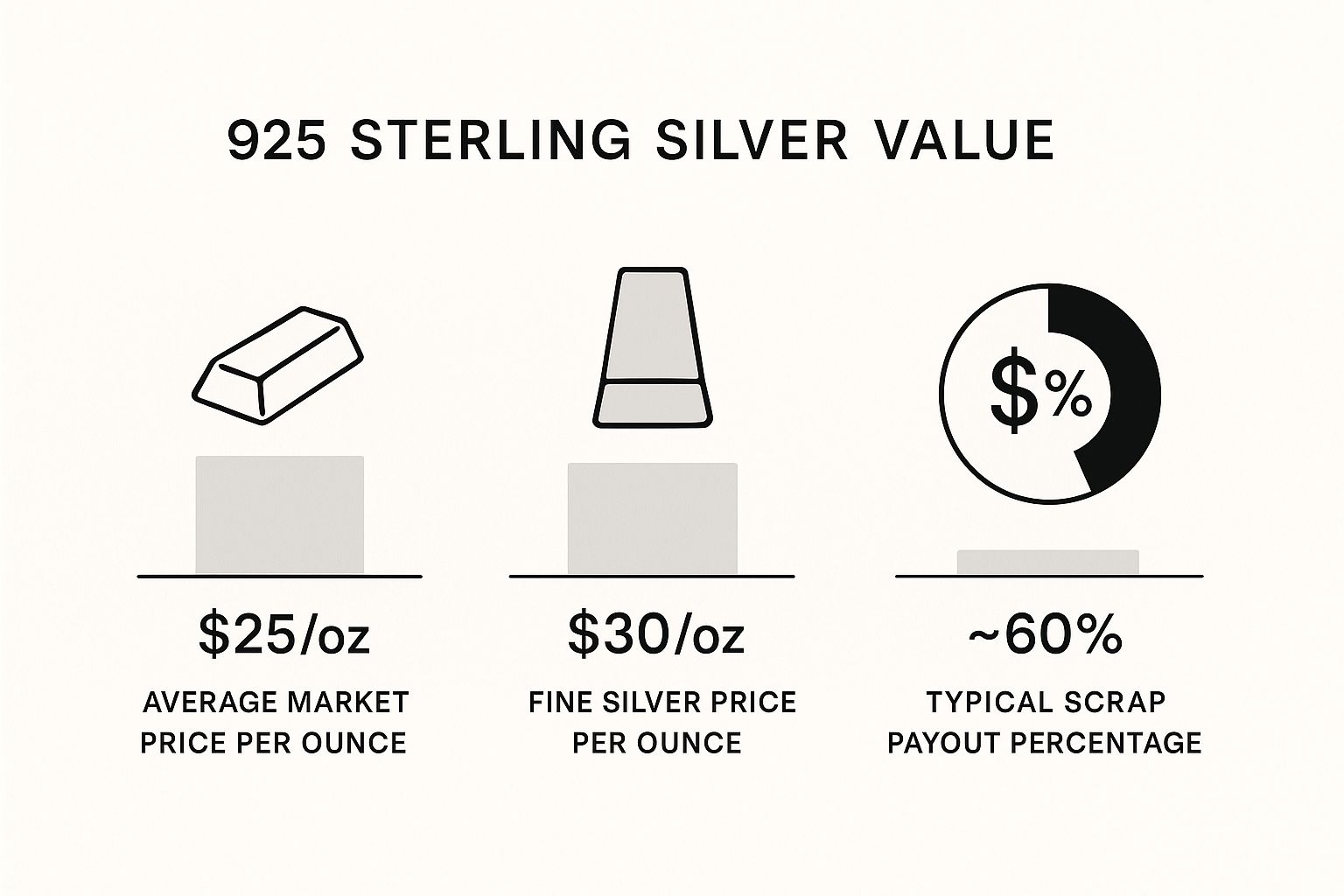

This infographic gives you a quick visual breakdown of the price differences you can expect.

As you can see, the scrap or melt price is often a fraction of what an item can fetch on the open market. It’s a perfect illustration of why selling a piece for its design and craftsmanship—not just its weight—is almost always the better route.

Generally, you have two main avenues for selling your silver:

- Quick Cash Options: Think pawn shops or "cash for gold/silver" businesses. They offer the convenience of immediate payment. The trade-off? They almost always pay based on melt value, which can be as low as 60-70% of the spot price. You won't get anything extra for brand recognition or intricate designs here.

- Maximum Value Options: For unique, antique, or designer pieces, online marketplaces, auction houses, or consignment shops are your best bet. These venues connect you directly with buyers and collectors who are willing to pay a premium for rarity, design, and history.

Actionable Insight: Match your item to the right marketplace. A generic, broken chain is best for a melt-value buyer. But a vintage designer piece will achieve its highest price on a platform that values its artistic and historical worth. Don't take a designer bracelet to a pawn shop.

Choosing the right sales channel really comes down to what you have and what you’re hoping to get for it. The table below breaks down the most common options to help you decide.

Comparing Selling Options for Your 925 Silver

| Selling Channel | Potential Price | Speed of Sale | Best For |

|---|---|---|---|

| Pawn Shop | Low (Scrap Value) | Very Fast | Quick cash for generic or broken items. |

| Local Jeweler | Low to Medium | Fast | Scrap silver, but sometimes they buy secondhand pieces for resale. |

| Online Marketplace | Medium to High | Varies | Branded items, unique designs, and collectibles. Reaches a large audience. |

| Auction House | High | Slow | High-value antiques, rare designer pieces, or significant collections. |

| Consignment Shop | Medium | Slow | Designer and unique items, but you only get paid after it sells. |

Ultimately, taking the time to research your options pays off. For those looking to sell through digital platforms, understanding the nuances of the online market is essential. To help you navigate that world, our detailed article explains exactly how to sell jewelry online for the best results.

What's the Future Value of Sterling Silver?

When you look at the long-term value of 925 silver, you're really seeing the convergence of two major forces: cutting-edge industrial demand and ever-changing fashion trends. It's this dual identity that makes silver's future so interesting and gives us a good roadmap for understanding its potential.

The biggest factor propping up silver's value is its growing importance in industry. Think about the global push for green technology—silver is a critical component in solar panels, electric vehicle (EV) batteries, and the hardware needed for 5G networks. This isn't just a fleeting trend; it's a massive, sustained demand that creates a solid price floor for the metal itself, directly supporting the value of every sterling silver piece you own.

Because of this, many experts believe the price of pure silver is set for a significant climb in the coming years. A deep dive into various silver price forecast predictions on goldsilver.com shows a consistent theme: industrial consumption is expanding, but the silver supply isn't keeping pace. Since much of the world's silver is mined as a byproduct of other metals, producers can't just ramp up output overnight. This potential supply crunch is a key reason for the optimistic outlook.

Keeping an Eye on Jewelry and Fashion

Of course, industry isn't the whole story. The cultural appeal of silver jewelry also plays a huge part in its value, and tastes can differ dramatically around the world. To capitalize on this, watch these key trends:

- North America & Europe: The focus is on sustainability and authenticity. Look for growth in artisan-crafted, ethically sourced, and minimalist sterling silver. Pieces with a verifiable story or recycled content will gain value.

- Asia: While minimalism is rising among younger demographics, there remains a powerful demand for ornate, traditional silverwork tied to cultural events and status. Expect this segment to remain strong.

- Global Gen Z Trend: Across all regions, gender-neutral designs and stackable/layerable pieces are a dominant trend. Silver chains, simple rings, and versatile charms that allow for personalization have the broadest appeal.

Actionable Insight: The future value of your silver jewelry is tied to its adaptability. Classic, timeless designs that fit minimalist or layering trends have strong long-term potential. If investing, consider pieces that align with the growing demand for sustainability and authentic craftsmanship.

The outlook for silver is strong. Its essential role in technology, combined with its timeless appeal in fashion, ensures it will remain a relevant and resilient asset.

Common Questions About 925 Silver Value

When it comes to the value of 925 silver, a few questions pop up time and time again. Let's tackle them head-on so you can feel confident whether you're buying, selling, or just enjoying what you own.

Is 925 Silver a Good Investment?

Yes, sterling silver can be a smart and accessible investment. Its value is anchored to the global silver spot price, providing a solid floor. But unlike silver bars, well-crafted or designer 925 silver pieces have a second layer of value: their artistic and collectible worth, which can appreciate independently of the commodities market.

This dual-value nature makes it a unique asset, blending the stability of a precious metal with the growth potential of a collectible.

Actionable Insight: When buying 925 silver as an investment, prioritize signed pieces from reputable designers, vintage items in good condition, or styles that are timeless. These are most likely to appreciate beyond their base metal value.

How Can I Tell if My Silver Is Real?

Authenticating your silver is a critical first step. Here's a quick, actionable checklist:

- Check for Hallmarks: Look for stamps like "925," "Sterling," "Ster," or "STG." Use a magnifying glass, as they can be very small.

- Perform the Magnet Test: Real silver is not magnetic. If a strong magnet sticks to your item, it is not sterling silver.

- Get a Professional Appraisal: For any item you suspect is highly valuable, the only way to be certain of its authenticity and market worth is to consult a certified jeweler or appraiser.

Does Tarnish Lower the Value?

This depends entirely on the piece. Tarnish is a natural surface reaction that does not damage the underlying silver.

For modern or generic items sold for melt value, tarnish is irrelevant. However, for antiques, this tarnish is called "patina," and it is often desirable. Patina serves as proof of age and authenticity, and removing it can significantly decrease the item's value to a collector.

Actionable Insight: Before you polish a vintage piece, stop and assess. If it's an antique, leave the patina intact until you've had it appraised. You could be cleaning away its history and a significant portion of its worth. To dive deeper, check out our guide on whether sterling silver tarnishes and how to care for it.

At JewelryBuyDirect, we give you a direct line to the factory, offering the latest styles in high-quality 925 silver jewelry. Come explore our collection of over 120,000 designs and find the perfect pieces to grow your business at https://www.jewelrybuydirect.com.

to show code

to show code