Arthur Lynch | Tue Dec 30 2025

Reducing Total Cost of Ownership: A Guide for Jewelry & Accessory Businesses

When we talk about reducing costs in the jewelry and fashion accessories business, it's tempting to focus on one thing: getting the lowest possible wholesale price. But that's a rookie mistake. The real path to healthier profit margins is understanding that every single expense—from the moment a piece leaves your supplier to the day it sells (or doesn't)—piles onto its true cost.

The Real Cost of Your Jewelry & Accessory Inventory

That initial price on a tray of new rings or a box of fashion scarves? It’s just the beginning of the story. The full picture is what we call the Total Cost of Ownership (TCO), and it's the metric that actually determines your profitability. Focusing only on the cost per piece is a trap that can lead to some serious financial headaches down the line.

To get this right, you have to shift your thinking from "cost per piece" to the much smarter "cost per successful sale." This forces you to account for all the little expenses that crop up along the way. These are the costs that quietly eat away at your margins, sometimes turning what looked like a fantastic deal into a money pit.

Unpacking the Hidden Costs

The supplier's invoice is just one part of the equation. So many other factors contribute to your TCO, and simply knowing what they are is the first step toward building a more profitable, resilient jewelry or accessories business.

Let's look beyond the wholesale price. You've got quite a few other expenses to consider.

- Shipping & Logistics: These fees can be wildly different from one supplier to another and can easily inflate the final landed cost of your goods.

- Import Duties & Taxes: If you're sourcing internationally, these are unavoidable. You have to bake them into your pricing strategy from day one.

- Inventory Holding Costs: Every day an item sits in your back room or on a display shelf, it’s costing you. Think storage space, insurance, and—most importantly—capital that’s tied up and can't be used for anything else.

- Deadstock: This is the big one. The silent killer of fashion businesses. Unsold inventory, often the result of being forced into high Minimum Order Quantities (MOQs), represents a 100% loss on your investment.

To get a true handle on your inventory's real cost and protect your valuable assets, it's also smart to explore professional loss prevention services. They help tackle issues like theft and administrative errors that quietly add to your TCO.

Hidden Expenses Inflating Your Jewelry & Accessory TCO

The wholesale price is just where your costs begin. Here’s a look at the common expenses that often get overlooked but have a massive impact on your Total Cost of Ownership when sourcing jewelry and fashion accessories.

| Cost Category | Description | Impact on Your Business |

|---|---|---|

| Shipping & Freight | The cost to transport goods from the supplier to your business. This can vary widely based on origin, weight, and speed. | Directly increases the "landed cost" of each item, squeezing your potential profit margin from the start. |

| Import Duties & Tariffs | Taxes imposed by the government on imported jewelry and accessories. These are mandatory and often complex. | A significant, non-negotiable expense that must be factored into your retail pricing to avoid selling at a loss. |

| Holding & Storage Costs | Expenses related to storing inventory, including rent for space, insurance premiums, and security for valuable items. | This is a constant drain on cash flow. The longer an item sits, the more it costs you, reducing its overall profitability. |

| Cost of Capital | The money tied up in unsold inventory that could have been invested elsewhere in your business (e.g., marketing, new product lines). | Represents a lost opportunity. Stagnant inventory prevents you from being agile and investing in growth. |

| Deadstock & Obsolescence | The cost of inventory that becomes unsellable due to changing fashion trends, damage, or simply not connecting with customers. | A complete financial loss on both the wholesale cost and all associated expenses. This directly kills your bottom line. |

By keeping these categories front and center, you can start making procurement decisions based on the complete financial picture, not just the supplier's initial quote.

TCO isn't just an accounting term; it's a strategic framework. When you truly understand it, you can spot the financial leaks in your buying process and make data-driven decisions that actually boost your bottom line.

Why TCO Matters for Your Bottom Line

Getting a handle on TCO is about so much more than just saving a few bucks. It's about building a smarter, more competitive business.

When you start managing these hidden costs, you immediately improve your cash flow. You reduce your financial risk. Best of all, you free up capital to reinvest in things that will actually grow your business, like a great marketing campaign or expanding into a new product category. Having a solid grasp of these costs is the absolute foundation of any effective jewelry inventory management system.

With this understanding in place, you’re ready for the actionable strategies we’re about to dive into.

Mastering Sourcing to Lower Upfront Costs

When it comes to your total cost of ownership, your sourcing strategy isn't just a line item—it's the foundation of your entire business. Nothing else you do will have as direct an impact on your initial investment, inventory risk, and long-term profitability. The first and most critical move is to break away from the old, tangled supply chains loaded with middlemen.

Think about it: every intermediary, from the importer to the regional wholesaler, takes their cut. They all add their own markup along the way. By the time that piece of jewelry or that handbag gets to you, its price has been inflated several times over. This is exactly why finding a direct procurement channel is so powerful.

When you partner directly with factory-direct wholesale platforms, you completely change your cost structure. By cutting out those extra layers, you can get your hands on pricing that is often 15-30% below what you’d typically pay. That’s not a small discount; it’s a massive saving that immediately lowers your cash outlay and gives you much healthier margins on every sale.

The Power of No Minimum Order Quantities

Price is one thing, but the biggest handcuff in old-school sourcing has always been the Minimum Order Quantity (MOQ). Traditional wholesalers have a knack for forcing you to buy in bulk, a practice that locks up a huge chunk of your capital and creates enormous risk. A modern, agile approach to reducing total cost of ownership is all about flexibility, and that starts with tearing down the MOQ barrier.

No-MOQ sourcing is a total game-changer for a fashion business. Let's say you've seen a trend picking up steam online—chunky resin rings, for example—and you want to test them out.

- With a High MOQ: You're forced to gamble thousands of dollars on a huge batch, just hoping the trend lands with your customers. If it flops, you’re stuck with a pile of deadstock and a total loss.

- With No MOQ: You can order a small, strategic selection. This lets you test the waters with almost no financial risk, see what actually sells, and then confidently reinvest your profits into the pieces you know are winners.

This single advantage flips your inventory from a potential liability into a genuine asset. You’re no longer guessing; you're making smart, data-driven decisions. In the fast-paced world of jewelry and accessories, that kind of nimbleness is everything. To dive deeper into this model, check out our guide on the benefits of factory-direct jewelry sourcing.

Prioritizing Quality to Prevent Hidden Costs

A low sticker price is worthless if the products create headaches later. Poor quality is one of the biggest hidden drivers of your TCO, creating expenses that never show up on an invoice. You have to account for the cost of processing returns, the hours your team spends on customer complaints, and the long-term damage to your brand’s reputation.

This is where supplier certifications become non-negotiable. Look for proof from respected organizations like SGS (Société Générale de Surveillance). These certifications offer independent, third-party verification that a supplier meets global standards for quality, safety, and ethical manufacturing.

By insisting on certified suppliers, you are proactively managing risk. You're ensuring that the materials are as advertised and that the craftsmanship will hold up, drastically reducing the likelihood of costly returns and unhappy customers.

At the end of the day, a smart sourcing strategy for jewelry and accessories comes down to a balance of three things: direct-from-factory pricing, the flexibility of no MOQs, and an unwavering commitment to quality. Nailing this trifecta is the single most effective way to lower your upfront costs and build a more resilient, profitable business from the ground up.

Getting Your Logistics Right to Maximize Savings

It’s easy to think of logistics and shipping as the last, boring step in placing an order. But honestly, this is where a great deal can fall apart. I've seen it happen: you negotiate a fantastic wholesale price on a batch of necklaces, only to have it completely eaten up by sky-high or unpredictable shipping fees. Suddenly, a profitable order is barely breaking even.

Treating logistics as an afterthought is one of the most common mistakes I see retailers make, and it directly inflates your landed cost per item. The real secret to reducing total cost of ownership in this department is finding suppliers who offer predictability and simplicity. When a supplier’s shipping policies are straightforward and value-driven, they remove a huge variable from your financial planning.

Think about it. Finding a partner who offers something clear-cut, like free worldwide shipping on orders over $150, is a game-changer. Shipping is no longer a fluctuating expense you have to calculate every single time. Instead, it becomes a predictable part of your strategy. You know the exact threshold to hit to wipe that cost off your books, which makes every single order more profitable from the get-go.

Stop Wasting Time on Complicated Shipping Calculations

On the other hand, a surprising number of suppliers are still stuck in the past, using complex, weight-based shipping tables. This approach turns every order into a guessing game. You're left trying to figure out the final cost, making it nearly impossible to know your true landed cost per piece until the invoice arrives.

That kind of uncertainty bleeds into everything else. It complicates how you set your retail prices and makes managing your budget a nightmare. It just adds unnecessary friction to the buying process, making it harder to make quick, confident decisions when you see a good opportunity. In a market that moves as fast as fashion, that kind of operational drag is a serious hidden cost.

The best logistics policies are the ones you don't have to think about. When shipping is simple, affordable, and predictable, you can focus your energy on what actually grows your business: picking the perfect products for your customers.

Let's imagine a real-world scenario. A boutique owner has a specific style of earring go viral on TikTok. They need to restock, and they need to do it fast. Fast, trackable logistics aren't a nice-to-have; they're essential. They can't afford delays or surprise fees. A supplier with a simple, flat-rate or free-shipping model gives them the confidence to capitalize on that viral moment without worrying that hidden costs will demolish their profit margin.

Protecting Your Investment While It's on the Move

Beyond the shipping fees, we need to talk about what happens to your products on their way to you. A box of beautiful, shattered earrings or scratched handbag buckles arriving at your door is a total loss. You're not just out the cost of the product; you've lost the potential revenue from selling it. This is why solid damage protection isn't a "perk"—it's a critical risk management tool.

Always look for suppliers who include comprehensive damage protection as a standard part of their service. It shows they stand behind their products and their packing process. It gives you a vital safety net, ensuring you aren't left holding the bag for items broken in transit.

Along the same lines, a no-fuss returns policy is another key piece of the puzzle for reducing total cost of ownership. If you get a damaged or incorrect item, the fix should be quick and painless. A complicated or costly returns process just adds administrative headaches and delays your ability to get sellable products onto your shelves.

By prioritizing suppliers with strong policies in these three areas, you're essentially building a financial buffer around your inventory.

- Predictable Shipping Fees: This lets you eliminate guesswork and truly control your landed costs.

- Robust Damage Protection: It shields your business from the financial sting of shipping mishaps.

- Hassle-Free Returns: This minimizes the time and money you waste dealing with order issues.

At the end of the day, getting your logistics right means partnering with suppliers who view shipping and handling as a core part of their commitment to your success, not just a way to tack on fees. These policies directly protect your bottom line and are a huge factor in achieving a lower, more manageable Total Cost of Ownership.

Improve Your Cash Flow and Financial Flexibility

Lowering your total cost of ownership isn't just an accounting exercise—it's about putting real, usable cash back into your business. Smart procurement directly improves your financial health, giving you the breathing room to jump on opportunities instead of being choked by tight margins.

When you aren't tying up every last dollar in inventory, you unlock the ability to be more agile. You can finally get creative and make those aggressive moves you've been dreaming of to grow your brand.

This is where smart financing and purchasing options become your secret weapon. They can fundamentally change how you manage your money, moving you from a reactive position to a proactive one.

Use Buy-Now-Pay-Later to Fuel Growth

For any retailer, cash flow is everything. This is especially true when you’re staring down the barrel of a peak season like Black Friday, Christmas, or Valentine's Day. The old way of doing things meant a massive upfront cash outlay for jewelry and accessories, draining your bank account weeks or even months before a single customer makes a purchase.

Buy-Now-Pay-Later (BNPL) options designed for wholesale purchasing completely flip that script. It’s not just about delaying a payment; it’s a strategic tool that expands what’s financially possible for your business.

Let’s play this out. You know from your sales data that gold-plated hoops and trendy crossbody bags are going to fly off the shelves for the holidays. With BNPL, you can secure all the inventory you need to meet that demand without emptying your cash reserves.

That capital is now freed up for immediate, high-impact investments. You could:

- Launch a targeted ad campaign on Instagram and TikTok to drive holiday traffic.

- Invest in a pop-up shop at a bustling local market to find new customers.

- Upgrade your e-commerce site to make sure it can handle the holiday rush without crashing.

Instead of your money just sitting in boxes, it's out there actively working to grow your business. This is a core part of reducing TCO because it slashes the opportunity cost of holding stock. To get a better handle on your finances, it’s always helpful to explore the fundamental principles of small business cash flow management.

BNPL isn't a loan; it's a strategic cash flow tool. It lets you align your biggest expense—inventory—with your period of highest revenue, smoothing out the financial roller coaster of retail.

This idea isn't new. Other industries have been doing this for years to maximize their capital. For instance, recent analysis from AAA showed that the total cost of owning a vehicle dropped significantly thanks to lower depreciation and finance charges. In effect, car owners were able to extend the "asset life" of their cash. Jewelry professionals can use BNPL and damage protection to get a similar result, keeping cash fluid and productive instead of locking it up.

De-Risk New Supplier Relationships

Let’s be honest, trying out a new supplier always feels like a bit of a gamble. What if the quality isn't what you expected? What if their best-selling jewelry pieces are a total flop with your customers? The best suppliers get this, and they offer incentives that lower your initial TCO and help build trust.

An introductory offer, like getting 15% off your first three orders, provides a direct and immediate financial cushion. Think of it as more than just a discount—it's a way to de-risk the entire process of bringing on a new partner.

This initial price break gives you a crucial buffer. You can place smaller, more diverse test orders to get a real feel for their product quality, shipping speed, and how your customers react, all without a massive financial commitment. It lets you experiment with new styles—maybe you want to dip your toes into stainless steel jewelry or eco-friendly fashion accessories—at a lower cost, making that trial phase much more affordable.

By taking advantage of these kinds of financial tools, you’re not just buying products; you're making strategic investments that preserve your most valuable asset—cash—and using it to fuel smart, sustainable growth.

Building Supplier Relationships to Minimize Risk

It's easy to get laser-focused on hard numbers like wholesale price and shipping fees. But honestly, some of the most effective ways to lower your total cost of ownership have nothing to do with a spreadsheet. They’re found in the quality of your supplier relationships.

A solid partnership is more than just a series of transactions. It’s a long-term asset, a powerful buffer against the risks, uncertainties, and hidden costs that inevitably pop up in the fashion industry. Think about it: every minute you spend chasing a late order, dealing with damaged goods, or scrambling to find a new partner is a direct hit to your TCO. That's time and energy you can't get back—time you should be spending on marketing, sales, and delighting your customers.

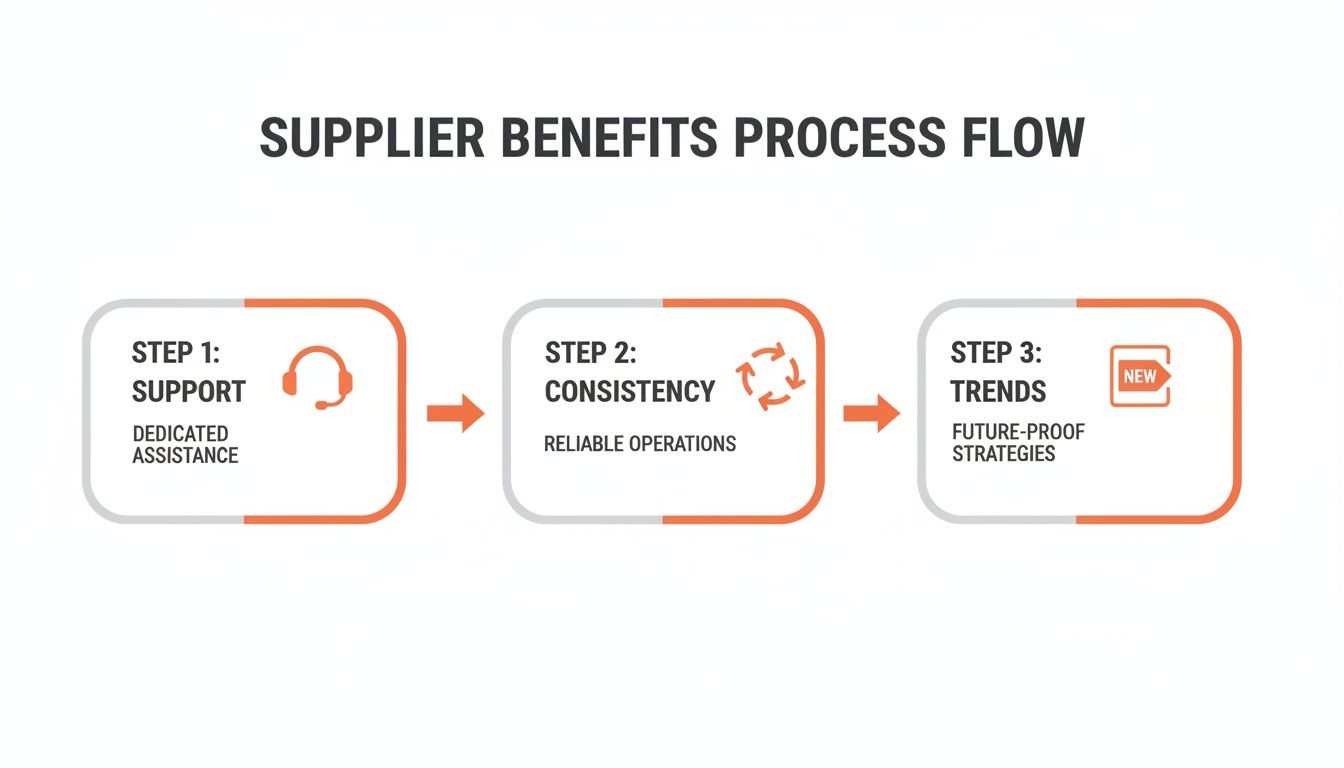

This is where things that seem "soft," like dedicated support, become incredibly valuable. Picture this: a customs issue holds up your shipment right before your peak season. Having a 24/7 dedicated support team to call is a lifesaver. Their quick action prevents a stockout, saving you from lost sales that could have tanked your entire quarter.

The Real Value of Consistency

In the fast-paced world of fashion accessories, consistency is gold. A supplier who delivers reliable quality and service, order after order, eliminates the constant, exhausting hunt for new partners. That whole vetting process—the research, the sample orders, the negotiations—is incredibly time-consuming and expensive.

A high repeat customer rate is a huge green flag. When you see a platform boasting an 85% repeat purchase rate, don't dismiss it as just a marketing stat. It’s concrete proof they consistently meet expectations. This directly lowers your long-term TCO by getting rid of the "switching costs" of finding and onboarding new vendors.

A great supplier relationship turns your procurement from a constant gamble into a predictable, stable foundation for your business. It lets you focus on growth instead of constantly putting out fires.

This stability really is a game-changer. Lowering your total cost of ownership isn't just a buzzword; it's backed by a smart business model. Some platforms, like JewelryBuyDirect, have built their entire system around mitigating these risks. They offer policies like 7-day returns and full damage protection, plus discounts like 15% off your first three orders. This helps businesses avoid the common traps set by high-MOQ suppliers that force you to tie up capital in slow-moving items like alloy rings or pearl bracelets. For their customers in major markets like the US, UK, and Asia, this reliability translates into high repeat buys, turning volatile fashion cycles into predictable profits. If you're interested in the nitty-gritty of financial models, you can find some fascinating parallels in recent vehicle TCO analyses.

Staying Ahead of Trends to Avoid Deadstock

One of the biggest, most painful hidden costs in this business is deadstock—inventory that goes out of style before you can sell it. A proactive supplier relationship is your best defense against this profit killer. The jewelry and accessory market moves fast, and your inventory needs to keep up.

A partner that adds 100+ new arrivals daily isn't just giving you more options; they're actively helping you manage risk. This constant flow of fresh styles lets you:

- Test micro-trends without a huge financial commitment.

- Pivot your collection quickly based on what's actually selling.

- Keep your store looking fresh and exciting for your regulars.

This approach is about proactively preventing yourself from getting stuck with last season's trends. It’s a crucial, but often overlooked, part of reducing your TCO over the long haul. By aligning with a supplier who's just as invested in staying current as you are, you ensure your inventory remains a dynamic asset, not a potential liability.

Your TCO Reduction Checklist for a More Profitable Future

Let’s translate these strategies into a concrete plan for building a more profitable and agile jewelry or accessory business. This isn't just theory; it's a practical checklist for reducing your total cost of ownership, starting today.

The first mental shift is to stop fixating on the initial price tag of an item. True profitability is a long game, one that involves managing the entire lifecycle of your inventory. Sourcing with no MOQs, for instance, allows you to stay nimble. You can test new trends without tying up significant capital and only go deep on proven winners. This turns your inventory from a potential liability into a genuine strategic asset.

Your shipping strategy is another place where profits are easily won or lost. You need to get serious about optimizing your logistics to protect your margins. A key part of this is partnering with suppliers who offer clear, predictable shipping policies—think free shipping over a reasonable threshold. Don’t let hidden freight costs sneak in and steal the profit you've worked so hard to build.

Your Actionable TCO Checklist

Use these points as a lens to examine your current procurement process. You can start making improvements right away.

- Look Beyond the Price Tag: Get in the habit of always calculating your true landed cost. This means factoring in not just the item price, but also shipping, duties, and even potential holding costs.

- Embrace No-MOQ Sourcing: Fight the urge to buy in bulk just to get a slightly lower unit cost. Smaller, more frequent orders are your best defense against deadstock and your ticket to better inventory agility.

- Make Shipping a Priority: When evaluating suppliers, give extra weight to those with transparent and affordable shipping. This is a direct line to protecting your margins.

- Guard Your Cash Flow: Don't let inventory eat up all your cash. Take advantage of flexible payment options like Buy-Now-Pay-Later to free up capital for marketing and other growth initiatives.

This process highlights the benefits a truly strategic supplier relationship can offer. It's not just about transactions; it's about getting consistent support, reliable quality, and staying ahead of market trends—all of which directly lower your TCO.

The real insight here is that the right partner actively prevents hidden costs. You spend less time and money dealing with returns, quality control issues, and clearing out old inventory that just won't sell.

Remember, reducing TCO isn't a one-time project you check off a list. It’s an ongoing discipline that directly fuels higher profits and sustainable growth in the hyper-competitive jewelry and accessories market.

Consider this checklist your call to action. You don't have to tackle everything at once. Just start by analyzing one area—maybe it's your current MOQ commitments or a deep dive into your shipping costs. Small, consistent adjustments will compound over time, leading to a much healthier bottom line and a more resilient business.

Your Top TCO Questions Answered

When you start digging into Total Cost of Ownership for your jewelry or accessory business, a few key questions always come up. I've heard these from countless retailers over the years, so let's clear them up with some practical, real-world answers.

How Does “No MOQ” Really Affect My Bottom Line?

No Minimum Order Quantity (MOQ) isn't just a perk; it's a powerful lever for reducing your total cost of ownership. Think about it: you're immediately cutting the cash you need to tie up in inventory. That capital can now go into marketing, new displays, or other parts of your business that actually drive growth.

But the real game-changer is how it slashes your risk of deadstock. You can bring in a small batch of a new, trendy necklace style and see how it sells before committing to a larger order. This flips your inventory model from a reactive "just-in-case" scramble to a much leaner, more profitable "just-in-time" strategy. It also means less money spent on storing and insuring pieces that aren't moving.

Are Factory-Direct Prices Actually Cheaper After Shipping?

Factory-direct prices look great on paper because they cut out the middlemen. But the price you see isn't the price you pay. You always have to calculate the landed cost—the final price per piece once it's in your hands.

This is where you need to scrutinize a supplier's shipping policy. A vendor offering free worldwide shipping over a reasonable amount is a huge advantage. It prevents those low unit prices from getting wiped out by hefty logistics fees.

When you're comparing two suppliers, don't just look at the item cost. A supplier with a slightly higher price per piece but free shipping will almost always give you a lower TCO than one with a bargain-bin price and sky-high shipping charges. Do the math every time.

The single biggest hidden cost is often the opportunity cost of deadstock. This is inventory you paid for but cannot sell, representing money that is permanently lost and cannot be reinvested into winning products or business growth.

What’s the Biggest Hidden Cost I Should Watch Out For?

Hands down, the most damaging hidden cost in jewelry and accessory sourcing is the opportunity cost of deadstock. This is the cash you've spent on inventory that you simply can't sell. Maybe a trend died unexpectedly, the quality wasn't what you expected, or a high MOQ forced you to buy way too much. That money isn't just tied up; it's gone.

That’s why reducing total cost of ownership is really about playing smart defense.

Your best protection against the profit drain of deadstock comes from:

- Sourcing from suppliers with no MOQs.

- Partnering with vendors who consistently release new, on-trend arrivals.

- Insisting on strong quality control and high-quality materials.

Managing these factors is fundamental to a healthy business. For a broader look at financial management, you can explore some practical strategies to reduce business costs, which is really the heart of TCO reduction.

Ready to start reducing your total cost of ownership with smarter sourcing? Discover over 120,000 on-trend styles with no MOQ and free worldwide shipping at JewelryBuyDirect. Explore the collection and get 15% off your first three orders today at https://www.jewelrybuydirect.com.

to show code

to show code