Arthur Lynch | Thu Jan 08 2026

How to Improve Inventory Turnover for Jewelry Businesses

Improving your inventory turnover comes down to a simple philosophy: source high-quality, affordable pieces your customers love, sell them faster, and strategically clear out what doesn't move. For a jewelry retailer, that means finding beautiful, well-priced fashion accessories that genuinely resonate with your audience, using real data to guide your purchasing, and turning that stock back into cash as efficiently as possible.

Why Your Jewelry Inventory Turnover Is Critical for Cash Flow

We’ve all been there—staring at a display case filled with stunning pieces that just aren't selling. It's a common frustration, but it's more than just an aesthetic problem. Every one of those unsold necklaces and rings represents capital that's completely tied up. That's money you could be using to invest in new, on-trend designs, launch a marketing campaign, or just pay the bills.

This is precisely why getting a handle on your inventory turnover is a total game-changer for your business.

Think of inventory turnover as the heartbeat of your store’s financial health. It’s a straightforward metric measuring how many times you sell and replace your entire stock over a set period, usually a year. A high turnover rate is a great sign; it means your buying strategy is on point and customers love what you're offering. On the other hand, a low rate is a red flag that your cash is trapped in slow-moving items, putting a brake on your growth.

The Real Impact on Your Bottom Line

Slow-moving inventory doesn't just take up physical space; it eats up your financial resources. The longer a piece sits in your case, the more it costs you in holding costs and, more importantly, missed opportunities. The cash locked in that one sterling silver ring could have been used to source a dozen pairs of the affordable, gold-plated hoops your customers are actually searching for.

This is especially true in the world of jewelry and fashion accessories, where trends can pivot on a dime. Improving inventory turnover is all about building a more agile business that can respond to customer demand without the constant fear of overstocking. It's the key to unlocking consistent cash flow and building a truly profitable business.

Let's look at a practical example. Here's a tale of two hypothetical jewelry boutiques, each with $100,000 in average inventory, to see how different turnover rates play out in the real world.

Low vs. High Inventory Turnover: A Tale of Two Jewelry Boutiques

| Metric | Boutique A (Low Turnover) | Boutique B (High Turnover) |

|---|---|---|

| Average Inventory Value | $100,000 | $100,000 |

| Annual Inventory Turns | 1.0 (Industry Average) | 2.5 (Goal) |

| Cost of Goods Sold (COGS) | $100,000 | $250,000 |

| Gross Profit (Assuming 50% Margin) | $100,000 | $250,000 |

| Cash Flow Impact | Capital is tied up for a full year. | Capital is reinvested 2.5 times a year. |

| Business Outcome | Stagnant growth, missed trends. | Higher profits, ability to adapt quickly. |

As you can see, by increasing its turnover rate, Boutique B generated 150% more gross profit than Boutique A with the exact same amount of capital invested in inventory. That's the power of moving your product efficiently.

Setting Realistic Benchmarks

To start improving, you need to know where you stand. While many retail sectors aim for 4–8 inventory turns per year, the jewelry business is unique. Our products are high-value and lower-volume, so the pace is naturally slower.

Industry analysis shows that most jewelry stores average just 1–2 inventory turns annually. For a boutique with $200,000 in average inventory, simply moving from 1.0 to 2.0 turns could effectively double your sales potential from $200,000 to nearly $400,000—without spending a dime more on stock. You can find more insights about jewelry industry benchmarks to see how your own business compares.

A low turnover rate isn't just a number on a spreadsheet; it's a direct reflection of your purchasing decisions. Every unsold item is a lesson in what your customers don't want, providing valuable data to refine your future sourcing strategy for high-quality, affordable accessories.

Ultimately, mastering inventory turnover transforms your store from a static collection of pretty assets into a dynamic engine for revenue. By focusing on smart buying, strategic selling, and efficient operations, you ensure your capital is always working for you. This guide will walk you through the actionable steps to make that a reality.

First, Calculate and Benchmark Your Current Turnover Rate

Before you can make smart changes to your buying and selling strategies, you need a clear, honest picture of where your jewelry business stands right now. You can't improve what you don't measure. The starting point for all of this is one key metric: the inventory turnover ratio.

It might sound like something out of an accounting textbook, but it's a simple calculation that reveals how efficiently your business is operating. It tells you exactly how many times you’ve sold through your entire stock over a specific period, usually a year.

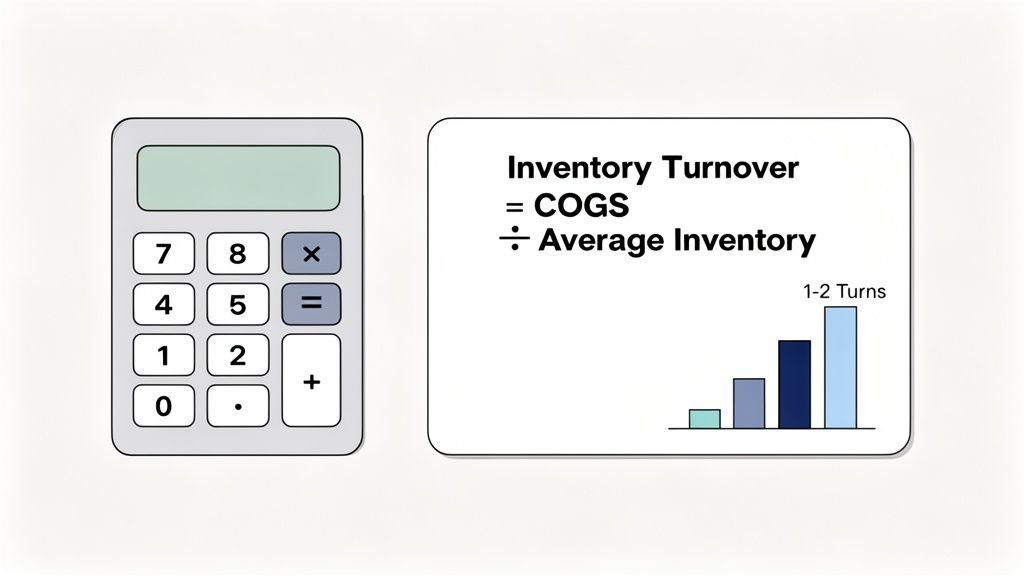

The Simple Formula for Inventory Turnover

The formula itself is refreshingly straightforward. You just need two numbers that should be readily available in your accounting or point-of-sale (POS) software.

Inventory Turnover = Cost of Goods Sold (COGS) ÷ Average Inventory

Let's quickly break down where you can find these figures.

-

Cost of Goods Sold (COGS): This is the total direct cost of all the jewelry you sold during a period (like a year or a quarter). It’s the wholesale price you paid for the pieces, not what the customer paid. You'll find this on your income statement or profit and loss (P&L) report.

-

Average Inventory: This represents the average value of your inventory over that same period. To get it, just add your beginning inventory value to your ending inventory value, then divide by two. This figure is usually on your balance sheet or tucked inside your inventory management system.

If you want to skip the manual math, a good inventory turnover ratio calculator can simplify the process and give you an accurate starting point in minutes.

A Real-World Jewelry Store Example

Let's make this real. Imagine your small jewelry boutique is reviewing its annual performance. Here’s what the numbers might look like:

- Annual COGS: $75,000

- Inventory Value on January 1st: $45,000

- Inventory Value on December 31st: $55,000

First, you'll need to find your average inventory:

($45,000 + $55,000) ÷ 2 = $50,000

Now, plug those numbers into the turnover formula:

$75,000 (COGS) ÷ $50,000 (Average Inventory) = 1.5

This means your boutique sold through and replaced its entire inventory 1.5 times over the past year. This number is your baseline—the starting line for your race to improve.

For an even deeper dive, feel free to use our own tool built specifically for jewelers:

https://www.jewelrybuydirect.com/blog/inventory-turnover-ratio-calculator?articleId=610894610518

So, Is Your Number Good or Bad?

You've got your number, but context is everything. A turnover rate of 1.5 would be a disaster for a grocery store selling milk, but in the world of fine jewelry, it’s a completely different story.

Because jewelry is a high-value, lower-volume product, its sales cycle is naturally longer than fast fashion or electronics. The industry benchmark for a typical jewelry store is somewhere between 1 and 2 turns per year.

- Below 1.0: This is a red flag. It’s a strong signal that you have too much cash tied up in slow-moving or dead stock. Your buying strategy probably needs a serious overhaul.

- Between 1.0 and 2.0: You're operating within the typical industry range. There's definitely room for improvement, but you're not in a critical situation. This is the "good, but could be great" zone.

- Above 2.0: Excellent work! This indicates you have a healthy, desirable product mix and you're managing your stock efficiently. Fashion-forward or costume jewelry boutiques might even push for 3 or 4 turns.

Knowing your turnover rate and how it stacks up against the industry standard gives you a tangible goal. It transforms the vague idea of "selling more" into a measurable target, empowering you to make data-driven decisions about everything from sourcing to promotions.

Source Smarter, Not Harder

Once you have a handle on your turnover rate, the real work begins at the source. A healthy inventory turnover is built long before a customer ever sees a product. The key is to source smarter, focusing on finding high-quality, affordable jewelry and fashion accessories that align with what your customers truly desire.

The old way of sourcing often meant tying up huge amounts of cash in bulk orders to meet high Minimum Order Quantities (MOQs). This traditional approach is one of the biggest roadblocks to a healthy turnover. It forces you to make large bets on a few styles, locking up your capital and leaving you vulnerable if a trend doesn't take off.

Embrace the No-MOQ Revolution

Thankfully, modern sourcing—especially through B2B wholesale platforms—is turning that outdated model on its head. The game-changer here is the no-MOQ supplier. This isn't just a small perk; it's a fundamental shift in how you can manage inventory, protect your cash flow, and build a more resilient business.

When you partner with suppliers who don’t demand massive minimum orders, you gain a whole new level of agility.

- Test Trends with Minimal Risk: See that minimalist gold-plated necklaces are taking off? Instead of committing to 100 units, you can order a small batch of five different styles. This lets you validate demand with real sales data before investing heavily.

- Keep Your Assortment Fresh: Customer tastes change rapidly. No-MOQ sourcing allows you to introduce new pieces weekly, not just seasonally, keeping your collection exciting and giving loyal customers a reason to return.

- React to Demand Instantly: Did a certain pair of sterling silver hoops just go viral on TikTok? With a flexible supplier, you can place a restock order immediately and capitalize on the trend, rather than waiting until you can afford another bulk shipment.

This approach transforms your inventory from a static, high-stakes gamble into a dynamic, responsive asset. You’re no longer guessing what might sell in six months; you're using real-time data to refine your collection on the fly.

The goal is to make smaller, more frequent purchases. This strategy directly boosts your inventory turnover ratio by keeping your average inventory value lower while maintaining or even increasing your sales volume.

Aligning Your Sourcing with Market Demand

Sourcing smarter is also about sourcing with data. You have to align what you buy with proven jewelry demand trends. The global jewelry market is expected to grow from roughly US$381.5 billion in 2025 to US$578.4 billion by 2033, and online sales are a huge part of that growth. Here in the U.S., jewelers saw revenue climb 5% while average unit prices jumped 8.5% in the first half of 2025. What does this tell us? Tighter, well-curated collections with a higher perceived value are often outperforming stores with broad, unfocused inventories. You can find more jewelry market growth insights on grandviewresearch.com.

Platforms that drop hundreds of new SKUs every day give you a massive leg up. You can run small tests on emerging styles, see what clicks with your specific audience, and then quickly double down on what works.

How to Identify the Right Sourcing Partners

Finding the right partner is absolutely critical to making this strategy work. Not all suppliers are built the same. As you evaluate potential wholesale partners, you're looking for a mix of flexibility, quality, and reliability. You need someone who will be a real partner in your growth, not just another vendor. For more help on this, our guide on the best wholesale jewelry suppliers can point you toward partners who get the modern retail landscape.

Here’s a quick checklist for vetting a potential wholesale supplier for high-quality, affordable jewelry:

| Feature | What to Look For | Why It Matters for Turnover |

|---|---|---|

| Order Flexibility | No or very low MOQs. | Lets you place frequent, small orders, cutting risk and freeing up cash. |

| Product Variety | A wide, constantly updated catalog of on-trend styles. | Allows you to test new trends without getting stuck with a single style. |

| Quality Assurance | Clear material specifications (e.g., gold plating thickness, gemstone type). | Guarantees product quality, which means fewer returns and stronger customer trust. |

| Logistics | Fast, reliable shipping with order tracking. | Gets products to you and your customers faster, so capital isn't tied up in transit. |

| Favorable Terms | Options like BNPL and damage protection. | Eases your cash flow, letting you reinvest in winning inventory more quickly. |

By focusing on these factors, you stop being a passive buyer and become an active curator. You build a sourcing process that directly fuels a higher inventory turnover, creating a healthier, more profitable, and more resilient jewelry business.

Turn Slow-Moving Stock into Immediate Cash

We've all been there. You walk past the display case and see the same pieces just sitting there, month after month. This "dead" stock isn't just taking up precious real estate; it's tying up your cash and dragging down your inventory turnover.

But instead of viewing these items as a loss, think of them as an opportunity. Every one of those pieces is cash in disguise, waiting to be freed up and reinvested into fresh, exciting designs that your customers actually want.

Pinpointing Your Slowest Sellers

First things first: you need to know exactly which items are the culprits. You can't fix a problem you can't see, and thankfully, the answer is right there in your data.

Dive into your Point of Sale (POS) system or inventory software and run a sales velocity report. You're looking for any SKUs that haven't sold a single unit in the last 90 days. That's a solid benchmark for fashion jewelry. For more expensive fine jewelry, you might stretch that window to 180 days, but the goal is the same. Tag these items so you have a clear list to work with.

Get Creative with Liquidation (It's Not Just About Discounts)

Your first instinct might be to just slap a big red "SALE" sticker on everything. While markdowns can work, leaning on them too heavily can erode your brand's value over time. A much smarter approach involves creative tactics that protect your margins and even make the customer feel like they're getting something special.

Here are a few strategies I've seen work wonders:

- Smart Bundling: Got a necklace that won't move? Pair it with a set of your bestselling earrings. Offer the bundle at a price that feels like a great deal but isn't a steep discount. This instantly raises the perceived value of the slower item by tying it to a proven winner.

- Gift-with-Purchase: Use a less popular bracelet as a free gift for anyone who spends over $100. This not only clears out the old stock but also gives your average order value (AOV) a nice little bump.

- Exclusive Flash Sales: Create some urgency with a short-term, online-only flash sale for your email list or social media followers. Making the offer feel exclusive motivates people to act fast. Mastering these kinds of promotions is a huge part of learning how to sell jewelry online successfully.

Let Your Dead Stock Teach You Something

Clearing out old inventory is about more than just a quick cash infusion. It's a masterclass in what your customers don't want. Every piece that didn't sell tells a story.

Don't just discard the slow-movers—analyze them. This data is pure gold for refining your future buying strategy. It’s just as valuable as knowing what sells well, because it tells you what not to purchase next time.

For instance, if you notice that big, ornate cocktail rings consistently land on your 90-day "no-sale" list, that's a powerful signal from your market. It's telling you to shift your focus and investment toward the sleek, modern designs that are flying out the door.

This kind of feedback loop is what separates a good retailer from a great one. By actively managing your slow-moving stock, you’re not just cleaning house. You’re generating revenue, learning from your mistakes, and making room for new products that will keep your business healthy and your turnover rate high.

Fine-Tune Your Operations to Speed Up the Sales Cycle

Boosting your inventory turnover isn't just about what you buy—it's also about how you run the business behind the scenes. The nitty-gritty operational details, from your supplier agreements to how you pay your invoices, have a direct line to how quickly you can turn that beautiful jewelry back into cash.

By sharpening these processes, you speed up the entire sales cycle. It's about creating a system where your capital is always working for you, not sitting idle in a logistical jam or locked into a rigid payment schedule. A few small operational tweaks can mean your pieces spend less time on a shelf and more time making you money.

Get Smart with Your Supplier Terms

Your relationship with suppliers is one of your most powerful tools for improving turnover. It used to be that retailers had to take whatever terms they were given, but that's just not the case anymore. Smart B2B partners know that their success is tied to yours.

You should be looking for suppliers who offer terms that give you more flexibility and lower your risk. Two of the most important ones I always look for are:

- 7-Day Returns: Think of this as your safety net. It gives you the confidence to experiment with a trendy new collection. If that new earring style doesn't fly off the shelves like you'd hoped, you can simply send it back without taking a loss. That capital is immediately freed up for something you know will sell.

- Damage Protection: Nothing is worse than opening a shipment to find damaged goods. It’s a cash flow killer. A supplier who stands behind their product with solid damage protection ensures you aren't left holding the bag for a shipping mishap, keeping your money in play.

These aren't just nice-to-haves; they're strategic advantages. They protect your investment and empower you to keep your inventory lean and fast-moving.

Use Financial Tools to Free Up Cash Flow

How you pay for your inventory is just as critical as what you're buying. If you're tying up all your available cash in upfront payments, you're crippling your ability to jump on new trends or restock a bestseller that's suddenly flying out the door. This is exactly where modern B2B financial tools can make a huge difference.

Using Buy Now, Pay Later (BNPL) for your wholesale orders can be a total game-changer. Instead of shelling out for a massive order all at once, you get the inventory right away and pay for it over time, often with no interest. This immediately frees up your cash, letting you bring in a wider assortment of products without waiting for your current stock to sell through first.

The impact on your cash conversion cycle is huge. You can have new inventory on your floor and selling to customers before your first payment is even due. You're turning product into profit that much faster.

This single operational shift can have a massive impact on your turnover rate. Just look at the industry data: some high-value pieces, like diamonds, can sit in a store for up to two years, dragging turnover down to a painful 1X. But one leading jewelry group, by optimizing its operations, hit nearly 3.4 inventory turns.

Think about what that means for your bottom line. When a retailer pushes their turnover from just 1.2 to 2.0, a store with $150,000 in inventory effectively unlocks an extra $120,000 in annual sales capacity. You can discover more jewelry industry trends on tenoris.bi.

Put the Right Systems in Place

As your business grows, trying to track everything with a spreadsheet just won't cut it. It’s inefficient and a recipe for costly mistakes. This is where a solid inventory management system becomes essential for speeding up your sales cycle.

A good system gives you a real-time, at-a-glance view of what's selling, what’s not, and exactly when to reorder. For stores looking to get organized without a big upfront cost, exploring some of the free inventory management software options is a fantastic starting point. These tools can automate your tracking, cut down on human error, and give you the hard data you need to make smarter, faster decisions.

Your 90-Day Plan for Higher Inventory Turnover

Knowing how to improve inventory turnover is one thing, but actually putting those ideas into motion is where you’ll see the real results. This isn't about a massive, overwhelming overhaul. Instead, I've broken it down into a straightforward 90-day plan to get you from theory to a healthier bottom line in just three months.

We're going to focus on making a measurable impact right away. Think small, strategic shifts in how you work with suppliers, manage your cash, and get products to customers.

You’d be surprised how a few tweaks to your supplier relationships and cash flow can speed up your entire sales cycle. Let's get started.

Your First 30 Days: Diagnosis and Data

The first month is all about getting an honest look in the mirror. You can't improve what you don't measure, so this phase is dedicated to digging into the numbers and establishing a clear starting line.

Your goals here are simple but absolutely critical:

- Calculate Your Current Turnover Rate: Use the formula we covered earlier to get your baseline number. This is the figure you're going to beat.

- Identify Your 10 Slowest-Moving Products: Go through your sales data and find the exact SKUs that are just sitting there, tying up your cash and gathering dust.

Days 31-60: Execution and Experimentation

Okay, you've got your baseline and you know which pieces are weighing you down. Now it’s time to act. This second month is all about execution—clearing out the old to make way for what's next. We're turning that dead stock back into cash you can put to work.

Here’s your action plan for this month:

- Launch a Liquidation Campaign: Get creative. Use the strategies we discussed, like bundling those slow-movers with bestsellers or running a flash sale. The goal here is to generate cash, not necessarily to maximize profit on these specific items.

- Test a New, Trending Product: Take the cash you just freed up and place a small, low-risk order for a new, trending style. Find a supplier with no MOQ so you can test the waters without a huge commitment.

This two-part punch—liquidating old stock and immediately testing new trends with the proceeds—is the secret sauce for a high-turnover business. It creates a self-funding loop that keeps your inventory fresh and exciting.

Days 61-90: Building Sustainable Habits

The final month is all about making this new, agile approach a permanent part of your business. The goal is to turn smart inventory management into your new normal, not just a one-off project. This is where you lock in the habits that will keep your turnover rate strong for the long haul.

Focus on these two key objectives:

- Establish a Smaller-Batch Ordering Rhythm: It's time to move away from those huge, infrequent orders. Start placing smaller, more frequent orders based on what your real-time sales data is telling you.

- Recalculate and Celebrate: Run your inventory turnover calculation again. Compare the new number to your 30-day baseline. You've worked hard—take a moment to see how far you've come.

Common Questions Answered

When you're deep in the weeds of inventory management, a few common questions always seem to pop up, especially for jewelry retailers. Let's tackle some of the ones I hear most often.

What’s a Good Inventory Turnover Ratio for Jewelry?

Honestly, there’s no single magic number—it really boils down to what you sell. The goals for a fine jeweler are worlds apart from a fashion accessories boutique.

If you're in fine jewelry, your pieces are significant investments for customers. The sales cycle is naturally longer. Because of this, a healthy turnover ratio is typically between 1 and 1.5. Don't panic if it's on the lower end; you're selling heirlooms, not fleeting trends.

On the other hand, if you run a fashion jewelry business, you're playing a completely different game. Your inventory is all about what's hot right now. For this fast-paced world, you should be aiming for a ratio of 2 to 4.

How Can I Order More Often When Cash Flow Is Tight?

This is the classic catch-22 for so many retailers. You know you need fresh inventory to make sales, but you don't have the cash because old inventory is just sitting there. The key is to break that cycle by creating a self-funding system.

First things first, you have to turn that dead stock into cash. Use the aggressive markdown and bundling strategies we talked about to liquidate those slow-movers. It might feel like a loss, but it's actually an injection of vital capital back into your business.

With that new cash in hand, you can start buying smarter.

The real game-changer is finding suppliers with flexible terms. Look for B2B platforms that have no Minimum Order Quantities (MOQs) and offer buy-now-pay-later financing. This setup lets you place smaller, more frequent orders that perfectly match your sales velocity without tying up all your capital.

You’re no longer stuck in the cash-strapped cycle. Instead, you're nimble, responsive, and buying what your customers actually want.

Is It Better to Discount Old Jewelry or Bundle It?

Both are great tools in your arsenal, and knowing when to use each one is crucial. The right choice depends on the specific piece and what you're trying to achieve.

I always suggest trying bundling first. It’s a softer approach that protects your brand's value. Try pairing a necklace that isn't moving with a pair of your most popular earrings. This increases the perceived value of the deal and can move that stubborn item without slashing its price.

If bundling doesn't do the trick, it's time to be more direct. A well-marketed flash sale or a clear, deep discount is incredibly effective for the really tough-to-move pieces. The goal here is simple: convert that stagnant product back into cash as fast as possible to make room for winners.

Ready to source smarter and improve your inventory turnover? JewelryBuyDirect offers over 120,000 on-trend styles with no MOQs, factory-direct pricing, and flexible payment options to help your business thrive. Explore our collections today.

to show code

to show code